Fintech vs. Open Finance: What Businesses Need

The financial sector is in the midst of a huge change, mostly led by Financial Technology (Fintech) and Open Finance. While these terms are frequently lumped together, they are separate ideas that promise to reshape the way companies and individuals transact with money. The OpenFuture World, which is the biggest hub of this movement and motivates people to follow it, is not only an option today, except for learning these changes; there is only one way to stay alive, or to grow.

This guide will unpack what Fintech and Open Finance are, explain their major differences, and start to discuss how this affects your business. By paying attention to both, you can situate your company to capitalize on these massive trends for a competitive advantage.

Fintech Explained: Innovating Financial Services

Fintech is any technology developed to enable or make financial services more efficient, automated, or innovative. For years, that has meant back-end systems for traditional banks. Now, it’s a consumer-facing revolution. The fintech revolution has transformed financial services, rendering them far more convenient and user-friendly and wresting control out of bank branches and into smartphones.

Here are some of the most commonly known Fintech applications.

- Mobile Banking: Managing your accounts, transferring money, and paying bills on your phone.

- Digital Wallets: With services such as PayPal, Venmo, and Apple Pay, making payments is a snap. There will be around 4.4 billion digital wallet users by 2025, per Juniper Research.

- Robo-Advisors: Investors, especially millennial investors, have embraced automated algorithm-based platforms like Betterment, which democratize investment management by reducing costs. Robo-advisors are expected to have $2.2 trillion in assets under management.

Open Finance Explained: The Power of Shared Data

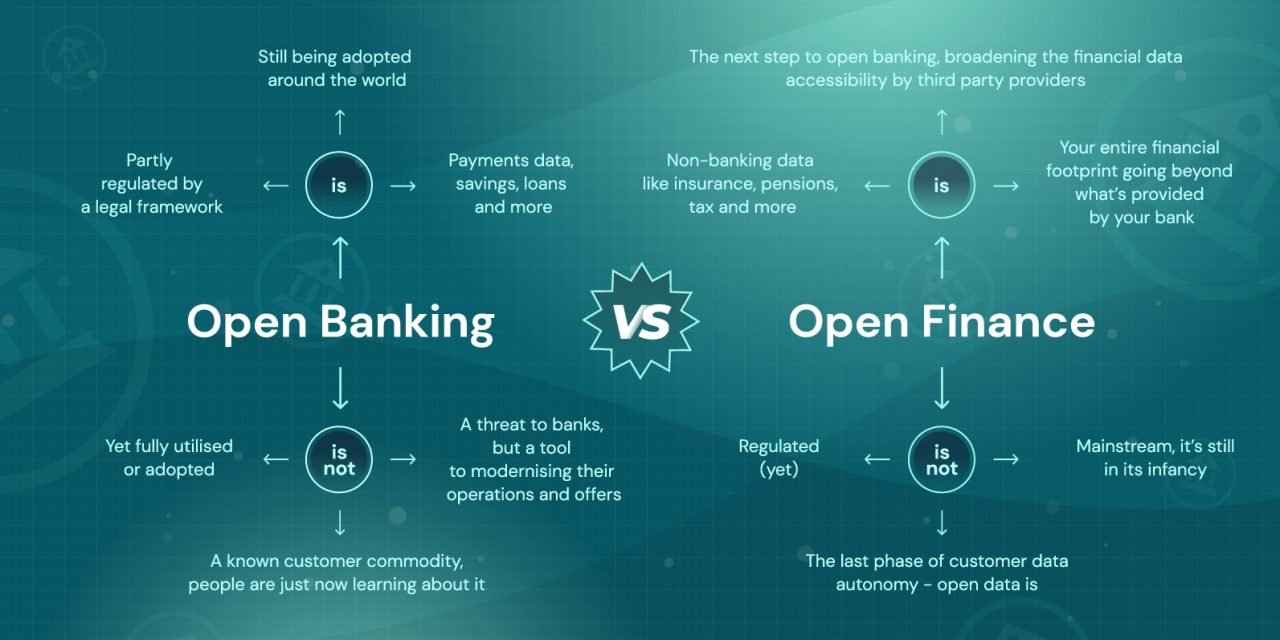

Open Finance is the evolution of what began with open banking. It’s a framework for customers to safely share their financial data from multiple sources (think bank accounts, investments, and insurance) with accredited third-party providers. This is achieved using Application Programming Interfaces (APIs) as secure links for data transmission.

The broad idea is to hand consumers more control over their financial data. If they are willing to share their data, this allows them to receive tailored products and services. Take, for example, a budgeting app that integrates with a user’s bank account, credit card, and investment portfolio to offer an overview of their overall financial well-being. It was infeasible to achieve such a level of integration previously.

Key Differences: Fintech vs. Open Finance

Fintech and Open Finance are closely connected, but they do different jobs. In a sense, think of it as Fintech companies are the innovators making new financial products, and Open Finance is providing the secure infrastructure on which many of these innovations are based.

| Feature | Fintech | Open Finance |

| Primary Focus | Creating new digital financial products and services. | Enabling secure data sharing between financial institutions. |

| Core Technology | AI, machine learning, mobile apps, blockchain. | APIs (Application Programming Interfaces). |

| Main Goal | Improve user experience, efficiency, and accessibility. | Give consumers control over their data to foster competition. |

| Example | A mobile app for stock trading (e.g., Robinhood). | A budgeting app that connects to multiple bank accounts. |

Benefits and Challenges

Both of these revolutions have their merits, but also bring challenges that businesses must find a way through. Suppose you’re analyzing information, studying a problem, or making a decision. In that case, the process can be much more organized and purposeful while using critical thinking exercises that are based on objective criteria, evidential support for issues, and logical thought.

Fintech

Benefits:

- Greater Accessibility: Fintech has brought financial services to underserved populations.

- Improved Efficiency: Automation streamlines processes, from loan applications to investment management.

- Lower Costs: Increased competition and reduced overhead often lead to lower fees for consumers.

Challenges:

- Regulatory Hurdles: The fast pace of innovation often outstrips regulation, creating uncertainty.

- Security Risks: As digital transactions increase, so does the threat of cyberattacks and data breaches.

Open Finance

Benefits:

- Enhanced Innovation: It allows smaller businesses and startups to develop new products by accessing data from established institutions.

- Personalized Services: Businesses can create highly tailored offerings based on a comprehensive view of a customer’s financial life.

- Increased Competition: By leveling the playing field, Open Finance encourages both new and old players to offer better products.

Challenges:

- Data Privacy Concerns: Securely managing sensitive financial data is paramount, and breaches can erode trust.

- Standardization Issues: A lack of universal API standards can make integration complex and costly.

The Future is Collaborative

It’s not Fintech versus traditional banks. Instead, it’s a collaborative endeavor, and Open Finance is the bridge. Legacy firms enjoy trust, a customer base, Fintech, and agility. By collaborating across Open Finance, they can deliver an open, efficient, and consumer-centric financial system.

Other Trends to watch: More AI for things like hyper-personalization, further growth of Open Finance, incorporating additional data types (pensions and insurance), and more sustainability in finance offerings.

What This Means for Your Business

Understanding the distinction between Fintech and Open Finance is the first step toward harnessing their potential. For businesses, this new era offers a chance to innovate, improve customer experiences, and create new revenue streams. By embracing Open Finance, you can gain deeper insights into your customers and develop the tailored solutions they now expect. The question is no longer if you should adopt these technologies, but how quickly you can integrate them into your strategy.